Factors to Consider

There are a number of factors to consider when thinking about which bank is “best”, here is a short list:

- Security (Ability to disable cash cards/debit cards, set daily and monthly limits, time of day limitations, block foreign transactions, etc).

- Ease of Use (Web site and mobile app usability, etc).

- Features (online banking, debit cards, sub-accounts, one time use virtual numbers, cardless ATM use, automatic transfers, etc).

- Fees (Charges for domestic and international transfers, withdrawals, deposits, etc).

- Language (Ability to use the bank in languages such as Chinese and English, in addition to Japanese).

- Physical branch and ATM locations.

- Support – How many credit card companies, utilities, etc. will let you use each bank as an automatic withdrawal (Direct debit) source, and whether your paycheck or pension can be deposited to this bank.

- Rates – Rates for savings and loans.

Security

When you open an account at any of the brick and morter banks (including JP Bank), they will ask if you want to allow your cash card to be used at other banks, or at convenience store ATMs, etc. I suspect most people say “Yes”, but typically if you use your own bank’s ATMs, transactions are free, or at least cheaper. The locations and operating hours are limited, of course. If you have an account you plan only to use for savings and access infrequently, you may opt to not allow access from other ATMs at all. Sometimes your bank’s ATMs will have additional security features, such as fingerprint scanning, etc. – so you will need to use their ATMs to get the best security.

Likewise, you can opt out of online banking with the megabanks, and your account will be even more secure. Likewise, debit cards are dangerous in that a single charge could wipe out your balance, and the money may be gone for a long time while you dispute the charge, so maybe don’t ask for a debit card for accounts that will hold huge amounts of money.

Cash card only cards also have another advantage over debit cards – a normal cash card (even one with J-Debit) has no expiration date. Cards with Visa, JCB, etc. debit features always have an expiration date and have to be replaced – typically every 4 years. This could be very inconvenient if you are living overseas for a few years or you move around replacement time.

With the net banks, using convenience store ATMs will usually be your main option, but they still have the ability to block foreign ATMs, block ATMs in certain regions, etc. Some banks (f.e. au Bank) let you quickly disable the card in the app, or even have it so that it automatically locks after a certain amount of time.

Password Cards and OTP/MFA Tokens

Often for online banking, you will have 3 options:

- A password card – This card has a matrix of numbers and letters on the back, and looks like a bingo card. When you try to make a transfer, etc., the site will prompt you, f.e. “A7”, and you need to read the character at A7, which say might be “9”, and type that in. These are usually free, and used by the likes of Mitsubishi and 7 bank.

- A hardware token – This is a little device or card that you can press a button on in order to get a one time password to enter when logging in or doing transactions. Sometimes they will charge extra for this. It is more secure and safer than using option 3. Mitsubishi, PayPay Bank, JP Bank (Yucho), Sony bank, and many more offer this. The JP Bank one can be complex to use, and the Rakuten does not offer such an option, preferring OTP emails instead.

- An OTP app – This will be an application on your phone that you can use to generate OTP codes just like the hardware token listed above. This has an advantage for the bank since it’s basically free to them, and the advantage for you that you don’t need to carry a separate token. This is also a disadvantage since it means you could be cohered into giving the code, you will need to set it up again whenever you upgrade your phone (or it is lost or stolen), and furthermore phones can be hacked. Mitsubishi, for example, has been nagging people to convert to this method.

Spending, Withdrawal, and transfer limits.

Most banks have some sort of system to allow you to set up daily or monthly limits of some sort.

Mitsubishi, for example, has a lot of options to set limits per transaction or per day for various categories, but like many banks, most of these limits can only be set per increment of 10,000 yen. This is useful for preventing someone from with access to you account from transferring out your life savings, but maybe not so useful to prevent you from taking out too much at the ATM once you’ve had one too many drinks.

Examples of banks with very fine controls include Rakuten Bank & JRE Bank (which is run by Rakuten). These both let you set limits at the 1000 increment for both cash card and debit card usage, as well as setting limits on which regions of Japan your card can be used in, and what times of day it can be used.

PayPay bank lets you generate virtual debit card numbers to use for online shopping, and each one can have a specific limit set.

Ease of Use

Ease of use is something I often hear foreigners complaining about, but honestly, I don’t feel the same way. Japanese web sites in general tend to be a lot “busier” than foreign sites.

Just compare the following sites from the most popular search engines in the US and Japan.

Quite a difference, right? But neither is better than the other. Most Japanese people prefer the “busy” look. It has more information, and more detail. You don’t need to click as many times to get to where you want to go – but there is much more presented at once which can overwhelm some people. This difference can be seen not only in web sites, but also mobile apps, PowerPoint presentations, etc. It’s not a failure of IT, but a cultural difference. If you live in Japan, you’ll need to get used to it at some point.

That said, some of the apps are “simpler” than others, often simply because they have fewer features. For Example, au Bank has a simpler app than PayPay – though I find both perfectly easy to use.

JP Bank is probably the most difficult bank to make transfers from, since you need to convert account numbers between the JP bank system and the system that every other bank uses if you want to transfer to an account that isn’t with JP bank. This is actually very easy once you get used to it (There is a set formula to use), and you can save “favorites” – but I am sure it can be confusing the first time.

The reason for this, incidentally is because JP bank was set up by the Post Office when it was still owned by the government, for people who couldn’t afford regular commercial banks.

Features

Online banking

Almost all banks offer online banking these days, but the web sites of “Traditional” banks are often clunky and somewhat difficult to use, even by Japanese standards.

Debit Cards

It’s important to know that there are two types of debit cards:

- International Branded debit cards (i.e. JCB, Visa, Mastercard, etc)

- J-Debit Cards

You can tell an international brand card because it will have the logo of the payment processor somewhere, and often a card number and expiration date (though this is becoming less common now with so-called “numberless” cards)

A J-Debit card is just a normal cash card with the J-Debit feature enabled. You can use these cards at major retailers such as BIC camera to make purchases just by using your PIN. I think most foreigners are not even aware of this feature.

Net banks often have virtual and sometimes disposable debit cards as well. For example, PayPay will let you generate Visa Debit card numbers in the mobile app. au Bank has a fixed number you can use.

Electronic Money

eMoney here has a very specific meaning. It refers to contactless payment using the Felica standard.

Common examples include Suica & Pasmo (which can be used on the train and bus as well), Nanaco, Waon, EDY (Which is becoming less common), QuickPay, and iD.

QuickPay and iD are similar to Visa touch, etc., in that the account information is stored on the card, but the money isn’t. This means you don’t ever need to “charge” these.

Suica, Nanako, etc. store your actual balance on the card itself, which means they process extremely fast (think 0.1 seconds), and don’t rely on the internet to work – but they need to be charged.

The above can [basically] only be used in Japan, but are better supported and more useful than features like “Visa Touch”, etc.

Cards with Visa/Mastercard/JCB Touch are also a thing, and can be useful for shopping overseas. Some cards even have both iD and Visa touch.

Some banks won’t have this technology built into the card, but let you install it on your phone instead, though often it will need to be a Japanese market phone.

Sub-accounts

Usually banks will only let you have one of a specific type of account, and since most people want “futsu” (normal) accounts, you can effectively only open one account. This means if you wanted to have one account for groceries, one for paying your utility bills, and one for saving up for that vacation, you would need 3 separate accounts.

This isn’t a big deal since most accounts charge no monthly fee, and many people have multiple accounts for transfer fee reasons (i.e. using the SMBC account when transferring money to your landlord who uses SMBC) – but it’s also mildly annoying.

Sumishin SBI has a “sub account” feature that lets you set up separate balances for things like “Winter Vacation”, “Pet Insurance Fund”, etc. You can create these, choose the name you like, and transfer money between them easily. Only the main account will be connected to the ATM/Debit card, so you can’t accidentally spend money in the other accounts.

Multicurrency Accounts

Many banks offer this in some form or another, but it is simpler with some banks than other. For example, Prestia and Sony Bank support a lot of currencies and make this very easy.

Cardless ATM

Some banks, f.e. au Bank and PayPay Bank have so-called “Cardless ATM” features, where you can use the app to scan a QR code on the ATM and take out money without using a card. This may be more of a curse than a blessing, though, since it means that leaving your card at home to prevent over-spending won’t work very well for the willpower deprived unless they install the app on a separate phone that they also leave at home.

Automatic transfers

There are two main types of automatic transfers.

- Where you set up an account to take money from another account on a set schedule once per month. These are typically free, but can only take money from your own accounts, only with a set timing, and there is usually a lag of a week or more from the time the money is debited from the source account and when it is available in the destination account. This can be useful, for example, to transfer 50000 JPY from your payroll account to your savings account at another bank without paying fees. Many banks have this feature, though with Megabanks you will probably have to submit a request using a paper form.

- Furikomi Transfers – These are the same transfers you would do from an ATM or Online banking, but you set them up to go automatically on a certain bank. They will charge fees the same as a manual Furikomi – but they can be very useful for paying bills, rent, etc. PayPay Bank, for example, supports this feature.

Fees

With the exception of Prestia, most Japanese banks don’t have monthly fees, but they do have fees for just about everything else. The main two fees most people need to be concerned about are ATM fees and furikomi (domestic transfer) fees.

With the megabanks, using their own ATMs is often free, but the operating hours of the ATMs are limited. There also may not be one within a convenient distance from you. One reason you see people lining up at ATMs at lunch time on pay day is the desire to withdraw cash curing operating hours from their own bank to avoid paying ATM fees.

With the net banks, they don’t have their own ATMs, so you can usually withdraw money from convenience store ATMs, and sometimes the ATMs of major banks as well. There will often be a few free withdrawals per month, with more being allotted to those meeting certain conditions, such as having their paycheck deposited to that account, having a related credit card, having a certain balance or certain amount of spending, etc.

Rakuten is a great example here. Even though they let you limit withdrawals at the 1000 JPY level, if you limited yourself to 5000 JPY per day to prevent impulse spending and watch your budget, you would need to withdraw money a lot more often, and end up paying a lot of ATM fees!

Rakuten has a “level” system, though, where as you meet more conditions, your level increases, and you can get more free ATM use and transfers. Most net banks have a similar system. (f.e. Sony, Sumishin SBI, and JRE have this style). The thing is, you may not want to keep a large balance in, or have your payroll deposited into an account you use mainly for daily spending, and you may not want to carry around the ATM card for the bank your payroll gets deposited into and bills are paid out of.

Transfer fees follow a similar pattern to ATM fees in general.

There are two stand-outs in the area of fees:

- JRE bank – Because the infrastructure of JRE bank is in fact run by Rakuten bank, the use of ATMs owned by convenience stores and other banks follows a similar pattern to Rakuten and other net banks – but – You can use “View Altte” ATMs present in JR Train Stations for free! Unlimited for all! No minimum balance requirement or anything like that. This is mainly useful for people in Tokyo, but an amazing benefit. Train stations are open long hours and conveniently located for many people. In a pinch you can still use convenience store ATMs.

- Sumishin SBI – Say you’re not in Kanto or you don’t have a JR station anywhere nearby your home or work, well then Sumishin SBI (Neobank) is still a great option. Just for setting up the mobile app with biometric security, you get 5 ATM withdrawals and 5 transfers to other banks for free. That’s more than any other bank I am aware of. The criteria to get 10 withdrawals and transfers is relatively easy to meet, and it’s possible to get up to 20. One way to get to 20 is to sign up for their platinum debit card. This is not free, but may be cheaper than paying ATM fees if you use the ATM a lot – and also comes with 1~2% cash back (depending on campaigns, etc)

Foreign Language Support

I’ll start by saying that I don’t think #6 is very important. Usually megabanks like Mitsubishi and SMBC will have good support and lots of branches, but fare poorly in most of the other categories.

I don’t think #5 is very important either. If you don’t know enough Japanese to use a bank account, learn it. Less than 2% of the population in Japan is foreign, and most of those are Korean and Chinese and learned the language before coming or were born here. There really is no excuse. If you insist on using a bank that supports English well, then you will be limiting yourself severely. (And in this case, look no further – 7 Bank or Prestia are probably the way to go).

Prestia (Also known as SMBC Trust) is what is formerly known as Citibank before they fled Japan. Citibank targeted wealthy westerners, and so supported English, and Prestia still does. Note that Prestia is one of the only banks to charge a monthly fee just for having an account.

7 Bank (owned by the same 7&i holdings company that owns 7-11 convenience stores and Ito Yokado supermarkets) mainly targets immigrant workers who want an easy way to send money home, just as people from Philippines and Indonesia. 7-11 ATMs also accept foreign cards and can give guidance in English, making them useful for tourists as well.

Physical Branch and ATM Locations

Many of the so-called “net banks” have no physical location at all – that’s why they offer lower fees, better interest rates, etc. Sony bank had one branch in Marunouchi, but that closed during COVID.

JP Bank and Mega banks have locations everywhere, JP bank basically anywhere there is a post office. It isn’t normal that you would physically need to visit a bank, and most of the banks are out to scam you with overprices investment products and insurance – so honestly I would avoid going to a bank branch when possible.

If you want to have a branch nearby, then JP Bank or a local bank is best for most people. (Local banks also offer better rates and easier approvals than Megabanks, and are necessary for certain government loans, etc.)

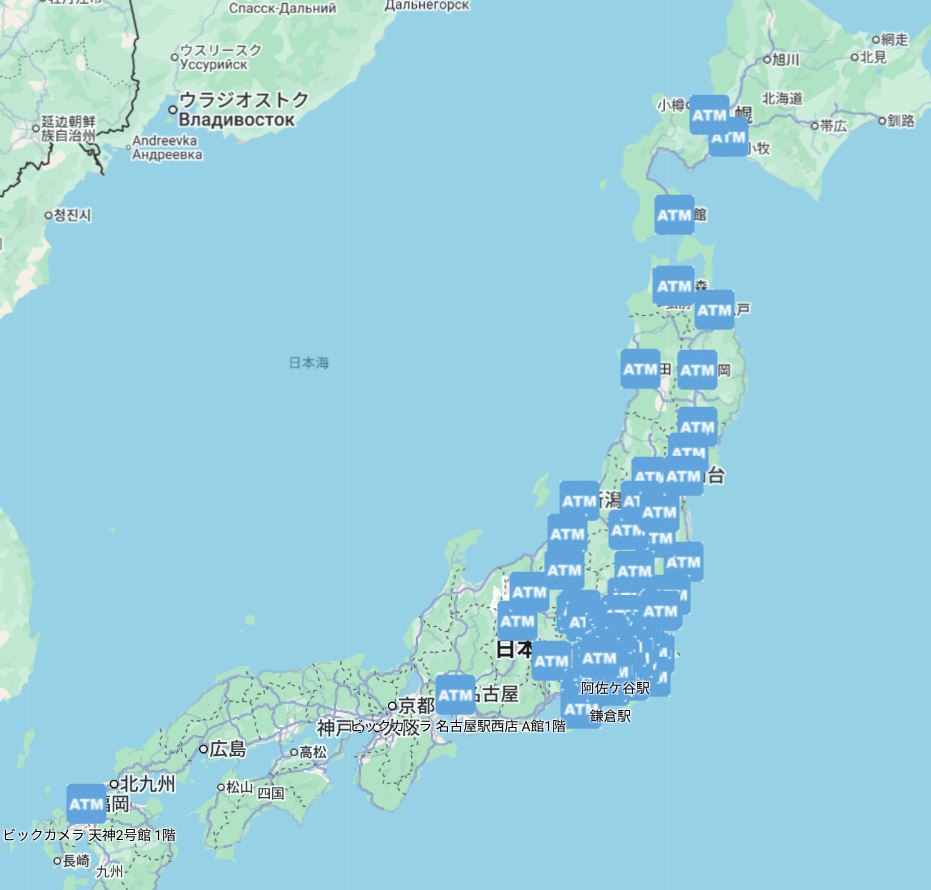

Prestia has fewer locations than the likes of SMBC and Mitsubishi, but of course the net banks have the most locations in the sense that you can usually use any ATM at 7-11 a few times per month for free. Again, JRE bank is the most impressive if you are near Tokyo, given that nearly every single JR station has a View Altte ATM. In fact, honestly, there are a lot quite far from Tokyo as well, as you can see below:

Support

“Support” here means support by other financial institutions, the government, employers, credit card companies, etc.

For example, with a megabank, it’s guaranteed that your employer will pay you there, the government will deposit your pension there, credit card companies will let you use the account for direct debit, etc. With some of the net banks, this is not always the case.

Employers will typically pay to any “normal” bank (traditional, regional, local, or net banks), but sometimes not pay JP bank accounts. In this case, you can just convert the account number.

Pension funds, etc. will often only pay to certain major banks.

Credit card companies can be picky. For example, you can select Mitsubishi bank as a direct debit source for View card, but you can’t select PayPay bank.

Likewise, loans payments can often only be debited from accounts at the same bank. (i.e. SMBC might only allow be to debit an SMBC account to pay a home loan). The above is another reason many people have accounts with multiple banks.

Interest Rates & Approval Rates

Rates are an area where net banks and small local regional banks almost always win.

Interest rates come down to simple math. Large brick and mortar institutions that have been around for hundreds of years and have to pay for lots of branch offices obviously have more employees and higher operating costs.

Even though operating at vast scale has allowed them to out-compete the likes of Citibank and HSBC, it’s hard to compete with net banks that have only a small fraction of the fixed costs.

Simply put, this means that net banks can typically offer higher savings account rates, lower loan interest rates, and lower fees than megabanks. They have the same insurance and regulation, so there is usually literally no reason to use a Megabank (other than the fact that other people use them).

On the other hand, approval rates at Megabanks can be lower than net banks. They will often demand more documentation, and be less willing to approve loans. There are certain large banks that will approve loans more easily, but charge much higher interest rates (Resona and SMBC Trust come to mind).

Loans are also easier to obtain from regional banks and trusts (Think: Bank of Yokohama)as compared to megabanks like Mizuho, MUFJ, etc.

Most banks will also want foreigners to have Permanent Residency status before handing out large loans, though this can be worked around in many cases by setting up a Japanese company to take out the loan instead. Credit cards can be easier to obtain.

Conclusion

This entry was meant to be an introduction, however we will cover specific banks in more detail in the future.

For now, know that if you need English, then Sony, 7 Bank and Prestia are your main options.

If you want tight ATM controls, then Rakuten and JRE Bank are your options.

If you want a lot of free ATM use at all hours, then JRE Bank and Sumishin SBI are great options.

If you want to set up a lot of automatic transfers and/or set up a lot of virtual debit card numbers for online shopping, consider PayPay bank.

If you are looking for the best rates and easier approval, avoid Megabanks.

If you are looking for an account that has wide support, use Megabanks.

If you need to open an account ASAP and it should have a physical branch nearby, then JP Bank is a good option.

In reality, If you’re like most people, you’ll probably end up with at least one Megabank and one Net bank account.

Comments