This topic isn’t specific to Japan, but it does affect Japan more than many other countries for reasons that will become clear. Even if you are not reading from Japan, please feel free to continue reading, as this may well save you a lot of money anyway.

The Purpose of Insurance

The concept of Insurance dates back to at least 3000 BCE, where it was practiced in China by pooling goods and dividing them among multiple boats.

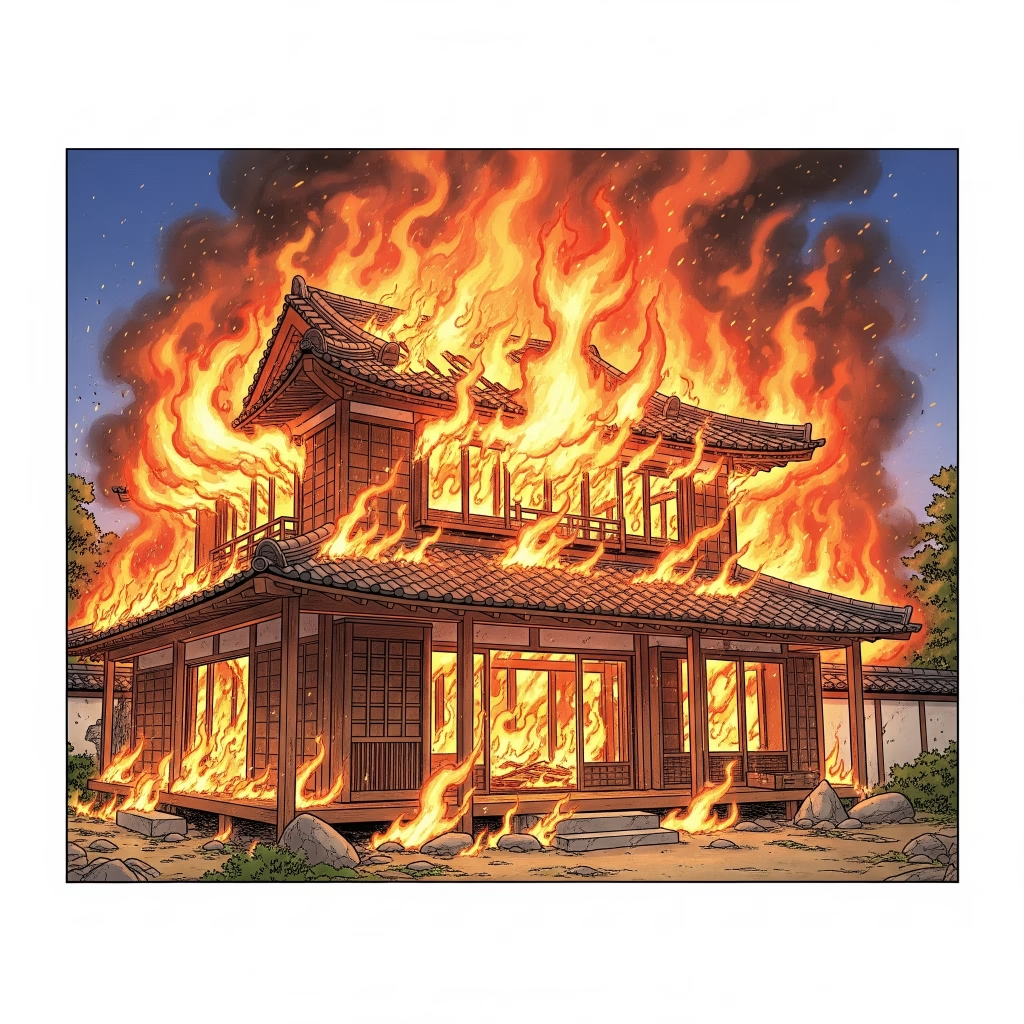

Modern insurance was born from the ashes of the 1666 great fire of London. Over 10,000 houses were burnt down, and fire became a major source of fear among the public. The first modern insurance companies were formed in this period to cover fire and marine ship loss.

The basic idea was as follows. A house is a very expensive asset that most people only buy once, if at all. It is the most expensive thing most people ever buy, and they may spend many years paying for it. If it burns down, they can’t ever recover. Since the majority of their assets may well be tied up in the house, they may become bankrupt without a place to live.

There is only a very small chance that a particular house will burn down in any particular year, but if your house does burn down, you are ruined and homeless. The risk is small, but if you win the unlucky lottery, the result is catastrophic.

Insurance is a way to spread the risk over a large number of people, so that instead of a few unlucky people losing their houses and going bankrupt, everyone will pay just a small amount.

Let’s use the example of a $250,000 USD house.

- Without insurance, if your house burns down, you are out $250,000. If it doesn’t burn down, you are down $0.

- Let’s say that through data analysis, you learn that the average chance of a house burning down is 1 out of 5000, or 0.02%.

- This means that on the average year, if you have 5000 houses, one will burn down.

- If you divide $250,000 by 5000 houses, you will get an average cost of $50 per house per year.

- To put it another way: If you were able to gather 5000 people, and convince them all to pay $50 per year, then you would gather $250,000 per year.

- If one of the houses burns down, you can use the money you gathered to buy a new house to replace the one that burned down.

- In effect, you turned a small chance of losing $250,000 into a 100% chance of losing $50.

Likewise, taking trips across the ocean can be perilous. There are huge storms and pirates, etc., so some ships never make it to their destination, or gave their goods stolen en route. This might only happen a small percentage of the time, but could bankrupt a small shipping company. Marine insurance can collect money from every insured sea voyage to cover the loss of a small percentage of ships or their cargo.

The above are ideal cases. In real life, insurance will cost more than the “expected value” because of the following:

- Administrative fees

- Fraud, and investigation to prevent fraud

- The need to maintain a buffer because while there are statistics and averages, the future is not perfectly predictable. For example, an earthquake may cause many fires to happen at the same time.

- For profit insurance companies will want to keep some of the insurance premiums as profit

Aside from the above, insurance is messy in real life because not everyone’s house will have the same risk of burning, or the same exact purchase cost. A concrete house is less likely to be damaged than a wooden one, and some houses can be repaired rather than replaced. Pirates robbing a ship cost less than if the ship sinks beneath the ocean.

Either way, the main point is that Insurance is a way of taking a large risk that you would never be able to handle without going bankrupt and turning it into a palatable payment instead.

Self Insurance

In the example above, the mathematically equivalent payment to cover a $250,000 house was $50 per year. If you owned 5000 houses, then you would be indifferent to buying insurance for all of them vs. not buying any insurance at all, because [assuming the statistics are accurate], you would be paying $250,000 every year either way.

In real life, insurance companies exist to make money, and even non-profit insurance cooperatives have administrative expenses, so if the “break even” fee was indeed $50 per year, the insurance premium you actually pay would be more – perhaps $60 or $70 per year.

This means that statistically, paying for insurance is always a losing proposition. If the insurance company is going to make money on average, then by definition the policy holders are always going to lose money on average. The point here is that most people don’t own 5000 properties, and can’t count on the law of large numbers to protect them. If losing one property would destroy you, then a small premium makes sense, to save you from the chance of losing it all.

If you could cover the loss, then insurance doesn’t make sense. In these cases, it makes more sense to “self insure” – that is, to set aside money to handle the losses that might occur. If you can do that, you will save money on average by avoiding the administrative costs and making insurance companies wealthy at your expense.

An Aside

Health insurance and Life insurance are outside the scope of this article because they aren’t really “Insurance” in the sense that we are defining here. Like it or not, we’re all guaranteed to get sick, and we’re all guaranteed to die.

In this sense, health insurance is spreading the cost of care among a large number of people so that you pay more than you otherwise would when you are healthy, and less than you otherwise would when you are sick – but unlike building fires, the chance isn’t that small.

Life insurance is also trying to protect against the inevitable, so in the short term it’s like buying a lottery ticket where you win only if you die.

Small Item Insurance and Extended Warranties

One thing that has become popular around the world in recent years is insurance on relatively inexpensive consumer goods. You can now get insurance on televisions, computers, toasters, tires, refrigerators, and mobile phones.

The important thing to know is that in all these cases the reason the companies offering these policies offer them is of course to make money. If they are making money, then in general you are losing money.

For example, if you buy a new refrigerator for $500 at Yodobashi camera, it will generally come with a 1 year warranty as standard. They will tell you “You can extend this warranty to 5 years by just using 5% of the points you get from this purchase!” This sounds great. The points were free anyway, right?

Well, not so quick. First of all, the points weren’t free. You could have gotten the same refrigerator elsewhere for 10% cheaper instead of paying more and getting 10% points. (If you don’t believe me, check kakaku.com).

Since we’re talking about a $500 refrigerator, then assuming you paid cash, you would get 10%, or $50 in points. Using half of those points is equivalent to paying $25 to insure your refrigerator. (Your refrigerator which you could have gotten elsewhere for $450…)

Since the refrigerator came with a 1 year warranty, you are essentially paying for 4 years of insurance. $25 divided by 4 years = $6.25 per year.

$6.25 / $500 = 1.25%, so the company is basically betting that the failure rate of the refrigerator is less than 1.25% per year. On other words, they are betting that they will only have to pay out on less than 1 our of 80 contracts.

So, I absolutely recommend buying products where this insurance is offered, since you can know that the company is confident that the product if reliable and will last a long time on average.

On the other hand, though, I don’t recommend actually buying the insurance. They are offering the insurance at the price they are because they are confident that they will “win”. Just like at the casino, the house always wins (on average at least).

Sure, you could get “lucky” and your refrigerator could break – but you’ll lose on average. The important question here is “Could I afford to cover the price of a new refrigerator?” This isn’t a $250,000 house, it’s a $500 refrigerator. If you can cover the cost, then you should. If you can’t, then you should take a hard look at your finances and bolster your insurance fund.

The same thing is of course true with computers, phones, and other items. If you’ve just bought a new computer to start your small business and you couldn’t afford to replace it, then by all means, buy the insurance – but your priority should be to get yourself into a place where you don’t need insurance.

I know it’s not what anyone wants to hear, but if you couldn’t afford to replace your iPhone Pro Max 16, then maybe you should look into buying an iPhone SE instead? If you pay 1,740 JPY per month, that works out to 20,880 per year. You can get a slight discount by paying for 2 years upfront, but either way, you are looking at around 40,000 JPY. That’s money that could have gone towards a new phone, but it is gone instead.

If you have a pet, then it would make more financial sense to start saving for medical expenses, instead of paying for pet insurance. If you can’t afford it now, then pay insurance while saving up.

Extended warranties are still the territory where one might say “It makes sense for some people”, because it’s something that has some value, even if it generates a profit for the companies selling it.

Insurance and Investment

This is where things get bad. While you should expect to lose money on extended warranties on average, financial products that mix insurance and investment are almost always in rip-off territory.

The first reason is because of lack of financial literacy. Many people don’t know what investment opportunities are available to them.

A supermarket Example

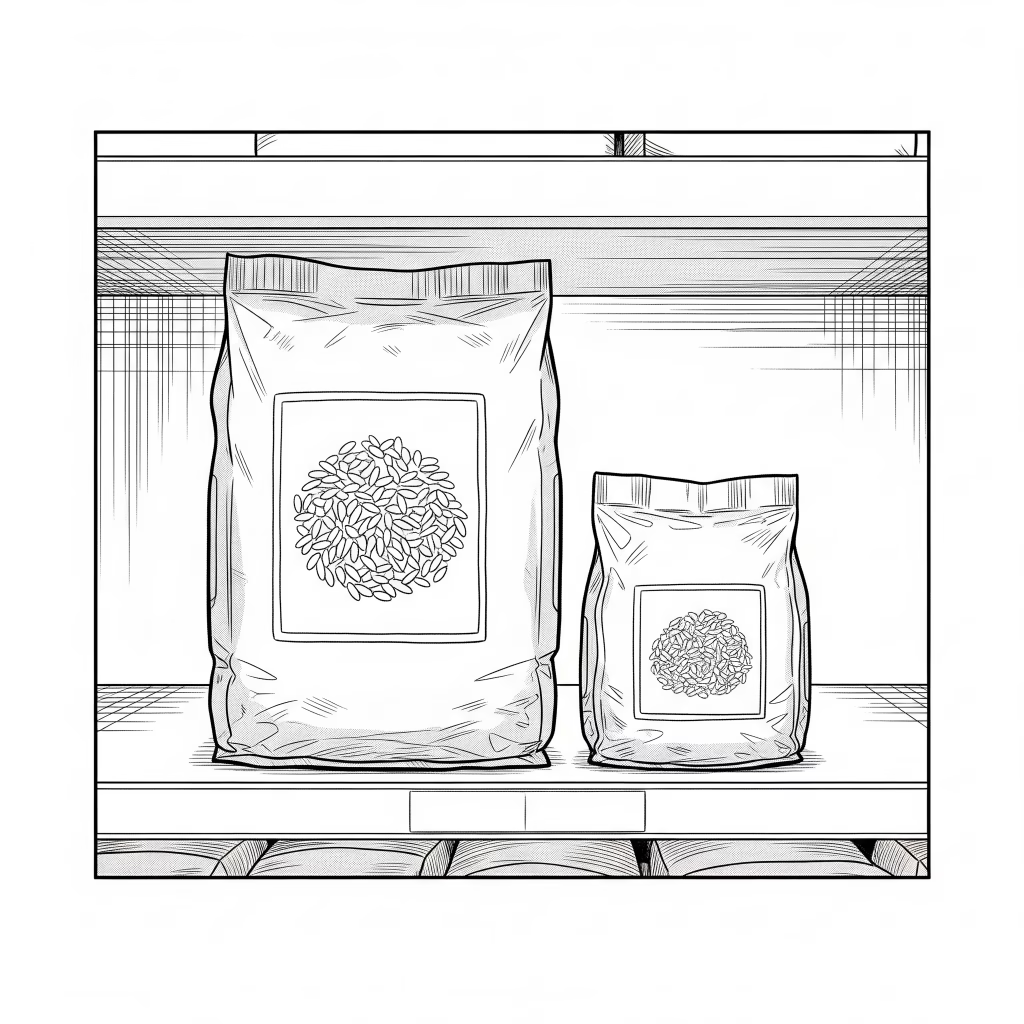

The second reason is because it’s hard to compare when you mix products.

Quick – Which is a better deal?

- 800g of rice for 1,000 JPY

- 1,100g of rice for 1,400 JPY

Most people would have a hard time guessing without calculating it out. Often people would assume that the larger package is cheaper, but that’s not always the case (and not the case in this example).

This is the reason many countries have laws where prices must be listed in cost per gram or cost per 100 grams.

Comparing Insurance policies

It’s easy to compare two insurance policies if they have the same coverage amount and restrictions, the cheaper one is a better deal. For example, if you want to insure your house against fire, and one company wants 5,500 per year while another will charge you 7,000 per year – well you should go with the 5,500 JPY policy.

It’s also easy to compare two insurance policies with the same premiums and restrictions – the one with the larger coverage amount is a better deal. For example, if two life insurance policies that are otherwise have identical terms, but one covers you for 10M JPY and the other only covers you for 9M. Obviously you want the 10M policy if everything else including the monthly premiums are the same.

In real life, since the restrictions, terms, and conditions vary, it might be difficult in practice to compare two insurance policies from different companies. For example, perhaps the 7,000 policy above is more expensive because it also covers floods. Is that worth another 1,500 JPY? It’s hard to tell unless you can find a flood only policy to compare it with.

Comparing Investment Products

Comparing investment products can also be simple in theory, but is often difficult in practice.

For example, if you are comparing two S&P 500 or TOPIX index funds, then it’s relatively easy. What they do is very well defined, so just choose the one with the lowest fees.

Comparing two REIT or High Dividend Index funds might be more difficult, though. The one with higher prices might have higher returns (and risk), or may just charge higher fees. Even here I would usually choose the one with lower fees, but the point is that the composition may be quite different for two supposedly different funds.

Mixing and Matching

Simple “Throwaway” Life Insurance (掛け捨て保険)

If comparing insurance policies and investment funds can already be difficult, then imagine how much harder it will be if you mix them into one product!

This is, of course, exactly the point. The fuzzier things become, the easier it is to rip off unsuspecting consumers.

Example:

You have a simple $1 million life insurance policy that charges you $100 per month. You start paying when you start working after graduating at 23 years of age, and you can continue the policy until you reach the retirement age of 65. That’s 42 years of paying $6k per year. The insurance company will have collected $252k from you by the time you are 65. Assuming you don’t die during that time, they don’t have to pay out anything. Meanwhile, they were investing that $252k and earning money on it, so they have, say $500k from the money you gave them.

They have determined that only 5% of people die before the age of 66, so if they sold this policy to 100 people, they would have collected $25.2 million that is now worth $50 million. They have to pay out $1 million claims to an average of 5 people from that group, so they pay a total of $5, leaving them with a profit of $45 million.

In reality, the insurance market is more competitive than that, so you would pay more like 15,000 JPY per month or so. In addition to that, most people would opt for something like like 20,000,000 JPY, not $1 million USD. As such, in reality, in Japan 10 year term life insurance rates range from ~4,000 JPY for people in their 20s to ~13,000 (females) ~23,000 (males) for people in their 60s.

Savings Life Insurance – Insurance as an investment (貯蓄型保険)

“Throwaway” insurance is all well and good. You pay for as much insurance as you need to cover your mortgage or expenses for any potential survivors above and beyond that and government programs such as survivor’s pension would provide.

But then the insurance salesperson gets a gleam in their eye, as they say “Or… you could choose our savings life insurance. You see, with the throwaway policy I just explained, you put in all that money over the years, and then it’s just gone. With the savings insurance, it’s an investment into your future. By paying just a bit more, you get life insurance and money will be left over. It is also great because you will earn more than the banks would ever pay you if you put that money into a bank account!”

Everything they say is technically true – but before you say “That sounds great, sign me up!”, let’s review a few things.

The disadvantages are so numerous as to boggle the mind:

- Returns below the rate of inflation – Japan has been in deflation for decades, but recently returned to inflation again. The “Assumed rate of Return” for these policies is often below 1%, while inflation is now above 2%. This means even if your money “Grows”, it will be losing ground to inflation.

- Assumed vs. Actual Rates – You might assume that since the rates are so low that they are at least guaranteed – but you would be wrong. Despite the marketing, the “Assumed Rates” they list are not a guarantee. Much of the profit comes from Japanese government bonds, and this yield fluctuates. Some insurance companies will invest in foreign bonds in order to earn a higher yield, but then currency exchange risk comes into play.

- Low Surrender Value – In order to keep you from cancelling your policy, the refund you would get from cancelling is much less than what you have paid in – especially for the first 10-15 years.

- High Costs & Fees – While insurance companies charge fees and take profits on normal throwaway life insurance, they are usually reasonable about since consumers can easily compare plans. With savings insurance, they go crazy. They take money for Agent Commissions (indeed, selling insurance can be very lucrative!), administrative costs, the insurance cost (obviously), and more. It’s very hard for your money to grow with all these fees eating away at it before it has a chance to hit critical mass!

- Rigid Fixed Payments – You are locked into a fixed premium payment schedule. Missing payments can cause the policy to lapse and cause you problems. Having money in a savings account at the bank or invested in stocks at a brokerage would help during a time of financial distress, but having to make insurance premium payments when you can’t afford it will make your situation worse!

- Inaccessible Funds – Your money is locked away. Unlike a bank or brokerage account, you can’t easily withdraw your own money! Sometimes you can take a loan against the value, but that means paying interest on something that was supposed to be making money for you.

- Savings vs. Death Benefit – This is where many people have the most critical breakdown in understanding. The way it’s explained, many people believe that savings life insurance is basically normal throwaway life insurance that also comes with an additional savings component. What really happens is this: When the policy holder dies, the beneficiaries receive the death benefit only. The “savings” is the death benefit. Basically speaking, the savings is simply how the insurance company funds the death benefit in this type of policy. To put it another way, if you die before the surrender value break-even period, then your relatives will receive less than the premiums you paid!

- Taxes – Some small amount of deduction can be made for life insurance policies, but the amount is truly trivial. Often salespeople will talk about tax deductions, without going into the details. Either they honestly don’t know, or they just don’t want you to know.

There is someone who will get rich if you buy savings insurance – it just isn’t you!

In summary, if you enjoy high fees and a low rate of return, then Savings life insurance is for you! I won’t look down on you – after all, I own stock in insurance companies, and I thank you for your patronage! All joking aside, savings insurance policies might possibly be a good idea for some super wealthy people who have already maxed out NISA and iDeco or company sponsored 401k accounts, in some situations.

Cultural Context

So why do people do it? Well everything explained have said above is true – but Insurance is especially popular in Japan.

If you ask your friends and co-workers about this, they might say “Oh you should sign up for savings life insurance. I do, everyone does – and you should too!” Before you take them too seriously, you should realize the factors in play. Their decision is almost certainly not based on calculations they have done, but social norms.

There are several deeply rooted cultural, historical, and social factors that contribute to the high rate of insurance ownership in Japan, even when the products may not offer the best financial returns. It goes beyond simple financial logic and is tied to a societal mindset.

Here’s a breakdown of the key reasons:

The Pursuit of Peace of Mind

This is a central concept in Japanese culture and a powerful driver for buying insurance. Anshin (安心) means peace of mind, security, and a sense of being free from worry. For many Japanese people and families owning a life insurance policy, especially one that combines protection and savings, is seen as the ultimate way to achieve peace of mind. It’s a psychological comfort, a tangible symbol of financial responsibility and preparedness for life’s uncertainties. The value is placed on this feeling of security, not just on the financial return. (Never mind that this peace of mind is a mirage).

This is not just a reason why people sign up for savings life insurance, but also for other types of insurance such as extended warranties, etc. Consumers get peace of mind, the companies get profits.

High Risk Aversion and a “Safety-First” Mentality

Following the devastating experiences of World War II and the “Lost Decade” of economic stagnation in the 1990s, the Japanese population developed a strong aversion to risk. This cultural trait is reflected in financial habits.

Preference for Stability: Japanese investors and consumers often prefer low-risk, low-return products over high-risk, high-return investments like stocks. They tend to favor savings accounts and government bonds, which offer stability even with minimal interest. Sadly, this means they often miss out on great returns they could be getting from their extra money. Even worse, savings life insurance policies aren’t just low return, but low flexibility and not really so low risk.

Fear of Failure: The cultural aversion to risk and failure is also a factor. In a society where lifetime employment was once the norm, leaving a stable job for a risky entrepreneurial venture carried significant social penalties. Similarly, a failed investment is viewed with much more severity than in some other countries. Insurance provides a “safe” way to “save” without the perceived risks of the stock market. (Again, savings insurance policies are often not nearly as safe as they may seem, but it is the perception that matters here).

Historical Context and Post-War Savings Culture

It’s important to understand that the history of Japan’s economic recovery after World War II played a crucial role in shaping financial habits for the previous generation.

Savings as a Virtue: Post-war economic growth was fueled by high rates of household savings. Saving money, whether in a bank or through an insurance product, was promoted as a virtue and a patriotic duty.

Savings Life Insurance as a Savings Vehicle: In the past, especially during the high-growth era, savings-type insurance offered attractive returns, making it a competitive savings tool. That’s no longer the case due to decades of low interest rates, the perception remains, and old habits due hard.

Government Policy: Historically, the government and financial institutions encouraged savings, and insurance companies played a significant role in absorbing these small individual savings to fund post-war economic growth.

Although these ways of thinking are a bit tempered among the younger generation, they have of course picked up habits and ways of thinking from their parents.

Aggressive Sales Tactics and Distribution Channels

Despite the poor financial returns, savings life insurance products are still widely and effectively sold in Japan.

Agent-Dominated Sales: The insurance market in Japan is heavily dominated by a vast network of agents who sell products through in-person meetings. High commissions for selling complex savings-type policies are an incentive for agents to push these products over simple, low-cost term life insurance. Insurance companies can afford to pay high commissions since they are charging rip-off level fees.

Bank Retail Windows: Japanese banks also sell insurance products to their customers. This channel is a powerful sales engine, as consumers trust their banks without evidence and don’t scrutinize the products as much as they should. Honestly, don’t ever buy anything at a bank window! This is one of the best pieces of advice I can ever give. The megabanks charge high fees for everything they sell this way to make up for the low profit in their core business. This is true not just for insurance, but mutual funds, etc. – you name it, and they have a rip-off version of it. They have to fund those fancy offices somehow.

Misleading Marketing: The products are often marketed with an emphasis on the “savings” aspect and the “peace of mind” they provide, sometimes without a clear explanation of the low returns, high fees, and the fact that the cash value is typically not paid out in addition to the death benefit. In some cases, sales scandals involving high-pressure tactics have also been a problem.

Social Obligation and Conformity

In a society that values group harmony and conformity, doing what your family or peers do is a powerful motivator.

Following the Norm: If friends, family members, or colleagues buy life insurance, there is a social expectation to do the same. It is seen as a sign of being a responsible adult and family provider. In short – it can’t be wrong is everybody’s doing it, right? This is the most likely reason someone might recommend you sign up for savings life insurance. Bear in mind that people have a psychological bias to believe that what they are doing is correct. Put simply – nobody wants to believe they are wrong.

Company Mandates: Some companies have group insurance schemes, further embedding the practice of having life insurance.

Cultural Context – Summary

In summary, while from a purely financial perspective, buying savings life insurance is not a logical strategy in Japan’s low-interest-rate environment, the deeply ingrained cultural values of peace of mind, risk aversion, historical context, and powerful sales channels make savings life insurance a common choice for a significant portion of the population. They are buying peace of mind and a sense of security, which they often value more than maximizing investment returns. Sadly, because of opaque fees and poor financial literacy, most of these people don’t actually know how much they are giving up to follow this strategy – and peace of mind doesn’t come cheap.

The Alternative

So what to do?

The Superior Alternative is throwaway life insurance + actual investing

In Japan, the more cost-effective alternative is almost always a throwaway term life insurance policy, plus a separate investment account.

Buy a “Throwaway” Policy: This is pure insurance. You pay a very low premium for a fixed period (e.g., 10, 20, or 30 years) and get a high death benefit. The cost is a small fraction of a savings life insurance policy, and if you die in the meantime, it will pay out the full benefit.

Invest the Difference: Take the significant amount of money you save on premiums and invest it separately in a tax-advantaged account like a NISA (Nippon Individual Savings Account) or iDeCo (Individual-type Defined Contribution pension plan).

Why this is better in Japan

Higher Investment Returns: With a NISA or iDeCo, you have access to a wide range of investment trusts and funds that can offer much higher returns than a life insurance policy, especially over the long term. This can be done while preserving the level of safety that the investor would like, for example:

- Index funds like S&P 500 and TOPIX – You can choose funds that follow the market and produce the highest average returns over the long term.

- Government Bonds – Low risk, but still higher returns than savings life insurance policies generally return. This makes sense, since savings life insurance policies usually earn most of their returns from government bonds, but then take a hefty premium, leaving less for the policy holders.

- High dividend stocks – Stocks with lower sensitivity to market conditions and higher dividend rates, which can be considered to be safer than index funds but more profitable than other options.

- Domestic vs. International Mix – Investors can control what portion of the funds are invested internationally in order to balance currency exchange risk with domestic economy recession risk.

Tax Benefits: Both NISA and iDeCo offer substantial tax benefits on investment gains, which is a powerful advantage in the long run.

Control and Flexibility: You have complete control over your investments and can access them (under specific rules for iDeCo and NISA). Funds stored in New NISA accounts can be taken out at any time, and without taxation of the profits.

In conclusion, while savings life insurance may be marketed as a “safe” way to save, Japan’s long-standing low-interest-rate environment has effectively stripped away its primary benefit. After all, opening a NISA and investing in Japanese government bonds would have an almost identical risk profile as a savings life insurance policy, but with tax advantages, more profit, and the ability to sell at any time without penalty. For the vast majority of consumers, a throwaway policy for protection combined with a dedicated investment plan like a NISA or iDeCo is a far more effective and financially sound strategy.

Personal Experience

Investment & Insurance

I personally have experience with iDeCo and 401k accounts in Japan, having invested these for over 10 years.

Shin NISA has only been around since 2024, but I have an account which I am actively contributing to. If you are familiar with the old NISA accounts, the new Shin NISA accounts are much better in every way.

With both of these iDeCo/401k and NISA accounts, the accounts are just buckets. This means you can invest in whatever you prefer. While I personally invest in index funds and high dividend stocks, the more risk adverse can choose to invest mainly in government bonds instead.

To put it another way my “peace of mind” is the balance in my NISA account.

I don’t have any private life insurance, as it’s simply not necessary for me.

I know numerous people who work in the insurance industry and make quite a bit more money than myself! – and my pay isn’t bad. That alone should tell you something. My hope is that everyone reading this will make themselves wealthy instead of making the insurance companies rich.

Self Insurance

SBI Sumishin allows you to open multiple “sub accounts”, which means you can easily set up separate accounts for specific purposes. Even better, it lets you set up automatic transfers so you don’t forget. For example:

- I have a “Pet Insurance” account that I put 2,500 JPY per month into. This account has over 150,000 JPY in it now.

- I have a “New Phone” account that has around 200,000 in it now. I put 4,000 per month, and haven’t replaced my phone in about 4 years.

- I have an “Emergency” fund, which I used to have set to 50,000 per month, but I have lowered to 10,000 per month once it hit 1,000,000 since there haven’t actually been any emergencies. (Any more than that is a waste to keep in a bank account earning basically no interest). Occasionally when an appliance dies, I spend some money from this account to replace it.

- As an insurance for my sanity, I also have a “vacation fund” set up as a separate account. I’m sure I’ll use it eventually.

The advantage is that you can stop transferring in money once the amount reaches what you would consider a reasonable maximum. You can then redirect that money to another account, or just invest it (or spend it) instead.

Comments